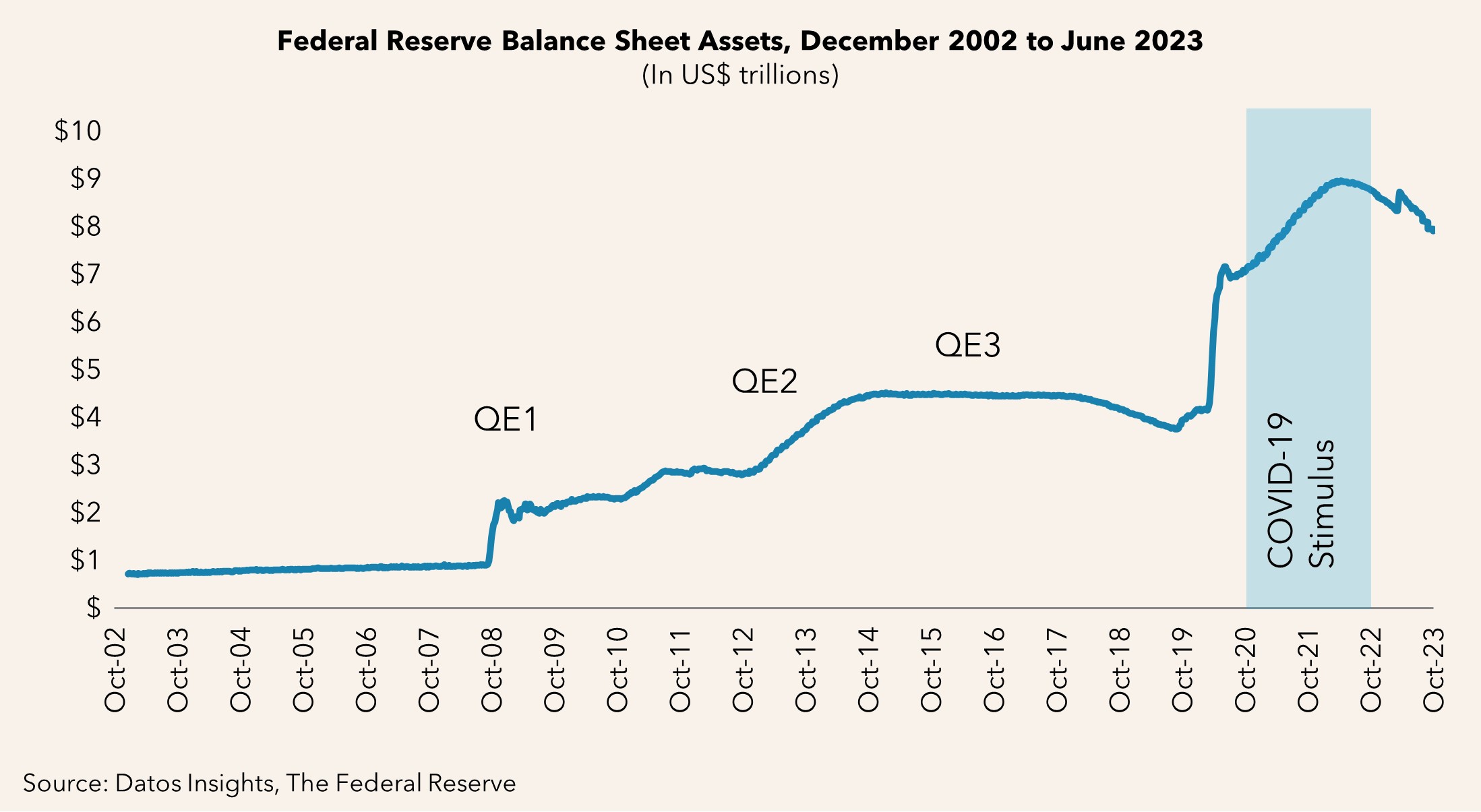

The more than US$25 trillion U.S. Treasury market, which transacts US$750 billion daily, is threatening to burst at the market-structure seams. In the immediate aftermath of the COVID-19 rattling of global markets, several bouts of extreme volatility and dislocation within the UST market put its complacent market structure in the crosshairs of concerned regulators. Regulators may pull the final thread that keeps the whole thing together.

This report assesses what brought the market to this point, the extent to which a potential regulatory overhaul may help or inhibit this critical market, who it may bring in or push out, and at what cost. This research reflects the perspective, insights, and opinions of the author. It integrates input from the broader Capital Markets team and insights gleaned from ongoing research on fixed income and over-the-counter markets, electronic trading solutions, regulatory issues, and market structure trends.

Clients of Datos Insights’ Capital Markets service can download this report.

This report mentions DTCC, FICC, ICBC, MarketAxess, and SIFMA.

About the Author

Datos Insights

We are the advisor of choice to the banking, insurance, securities, and retail technology industries–both the financial institutions and the technology providers who serve them. The Datos Insights mission is to help our clients make better technology decisions so they can protect and grow their customers’ assets.