Recent data shows that in the first nine months of 2022, investors in Europe favored “dark green” investment funds with specific sustainable investment objectives over those that broadly integrate or promote environmental, social, and governance (ESG) characteristics.

The EU’s Sustainable Finance Disclosure Regulation (SFDR) lays out three categories for investment funds to identify with:

- Article 6 funds either do not integrate ESG or sustainability considerations into the investment process and explain why they are not relevant, or they do integrate them broadly but do not meet the criteria for Article 8 or 9.

- Article 8 funds promote environmental and/or social characteristics, among other characteristics, and the companies invested in have good governance practices.

- Article 9 funds have sustainable investment as their core objective.

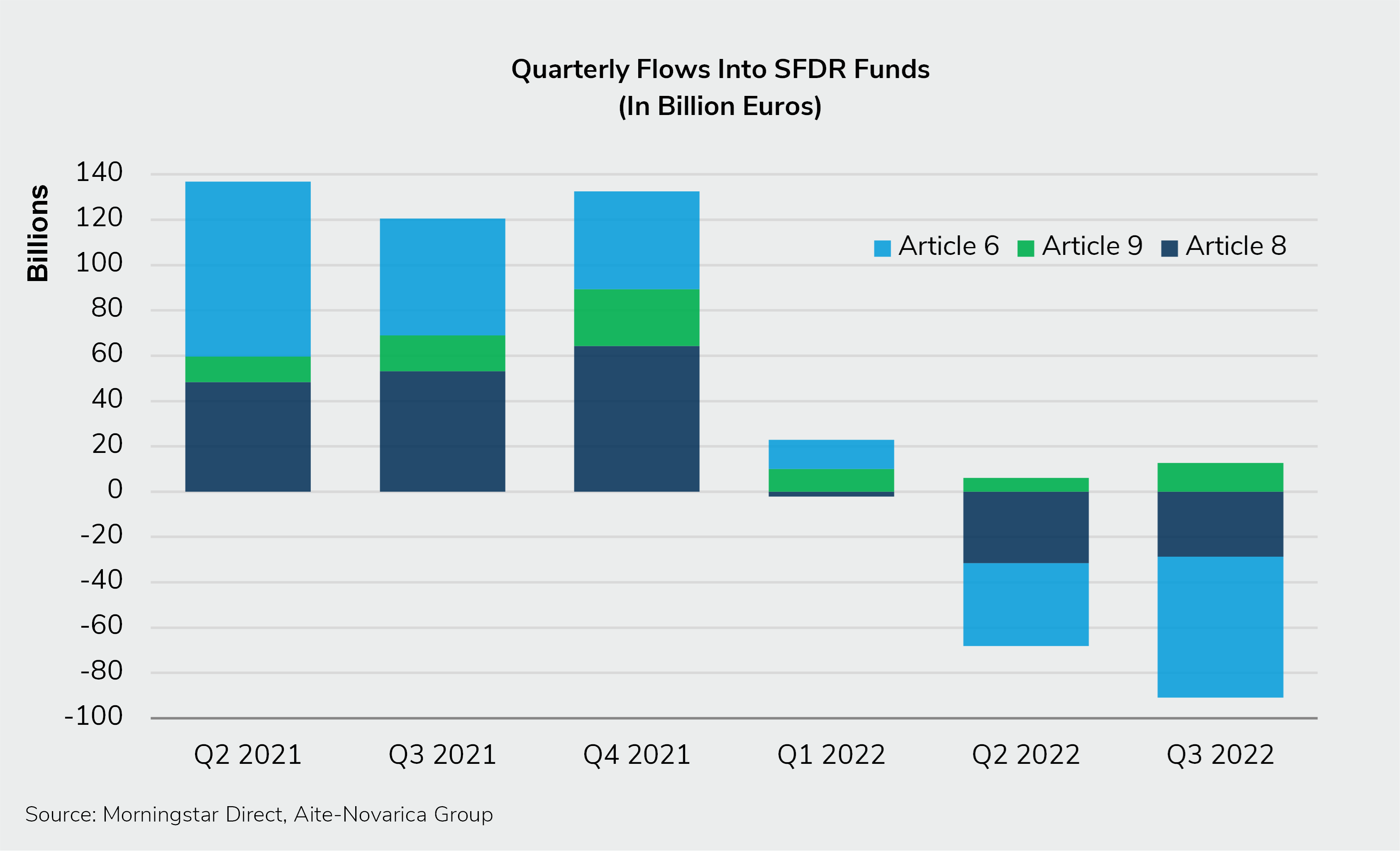

Despite challenging economic times marked by inflationary pressures, rising interest rates, a potential global recession, and geopolitical risks from Russia’s war with Ukraine, European investors continued to pour 12.6 billion euros into funds classified as Article 9 under the EU SFDR in Q3 2022 while bleeding 28.7 billion euros from Article 8 funds over the same period, according to data from Morningstar.

Looking back longer term, all European funds classified under SFDR experienced net inflows in the last three quarters of 2021. However, the nebulous nature of Article 8 and ongoing concerns in the industry around greenwashing appear to be driving European investors toward products that have a more clearly defined investment objective or strategy as it relates to sustainable investing.

Many have criticized the SFDR for its lack of clarity around Article 8 in particular, complaining that the range of funds that could claim Article 8 classification is much too wide and that it isn’t helping with the proliferation of greenwashing.

In fact, 64% of capital markets firms responding to Aite-Novarica Group’s 2022 ESG Survey indicated that they believe greenwashing is widespread in the investment industry, with only 5% of respondents disagreeing with the assertion. Additionally, nearly three-quarters of respondents (74%) in the same survey agreed that SFDR guidelines should be more explicit regarding what funds can be classified under Article 8.

Despite the flow movements, the latest numbers highlight that more than half (62.6%) of funds in Europe classified under SFDR were still non-ESG-affiliated products, or Article 6, while a third (33.6%) were Article 8, and the remaining 4.3% were Article 9. Morningstar’s data also showed that European asset managers reclassified the status of 383 funds under SFDR in the third quarter, 342 of which represented upgrades, with the vast majority (315) from Article 6 to Article 8. And although investors are flocking to dark green funds, managers downgraded 41 funds to Article 8 from Article 9 in that same quarter, likely due in part to the increased scrutiny and additional disclosure requirements that accompany an Article 9 classification.

As ESG fund regulations shift, products will continue to evolve, but overall they should allow true impact funds and those with clear sustainable objectives to stand out to investors seeking such vehicles. To learn more about developments in this space, as well as the impact other fund regulations like the SFDR will have on the investment management industry at large, read my colleague Paul Sinthunont’s and my latest report ESG Fund Regulation: Greenwashing Under the Microscope or contact me at asmith@datos-insights.com.